Fintech-as-a-Service Market to Reach USD 1305.7 Billion by 2032 | SNS Insider

The Fintech-as-a-Service market is poised for significant growth, driven by technological advancements and increasing demand for digital financial solutions.

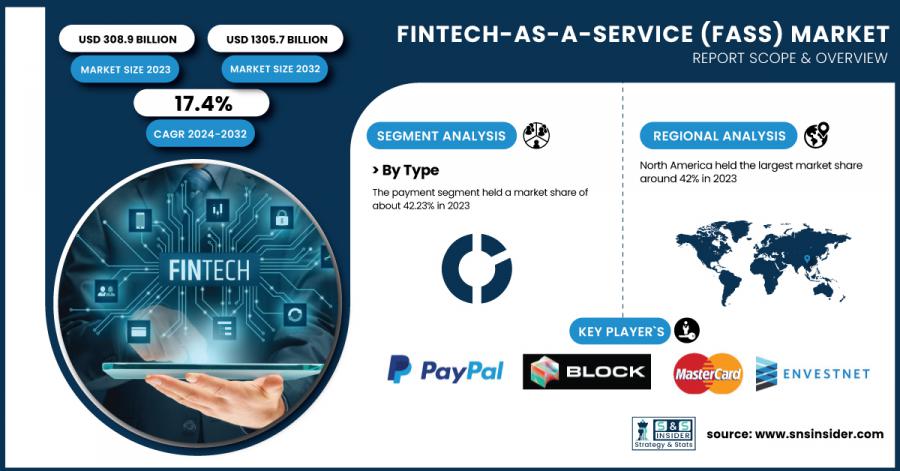

AUSTIN, TX, UNITED STATES, February 20, 2025 /EINPresswire.com/ -- The Fintech-as-a-Service market, valued at USD 308.9 billion in 2023, is expected to reach USD 1305.7 billion by 2032, growing at a CAGR of 17.4% from 2024 to 2032. This report includes an analysis of adoption rates of emerging technologies, network infrastructure expansion by region, cybersecurity incidents (2020-2023), and cloud services usage by region. The market is driven by increasing demand for financial technology solutions and services, alongside advancements in cloud computing and cybersecurity practices.

Get Sample Copy of Report: https://www.snsinsider.com/sample-request/3318

Keyplayers:

PayPal Holdings, Inc. (PayPal)

Block, Inc. (Square)

Mastercard Incorporated (Mastercard Payment Gateway)

Envestnet, Inc. (Envestnet | Yodlee)

Upstart Holdings, Inc. (Upstart Platform)

Rapyd Financial Network Ltd. (Rapyd Wallet)

Solid Financial Technologies, Inc. (Solid API)

Railsbank (Railsbank Banking Engine)

Synctera Inc. (Synctera Platform)

Braintree (Braintree Payments)

Stripe, Inc. (Stripe Connect)

Adyen N.V. (Adyen Payment Solutions)

Dwolla, Inc. (Dwolla API)

WePay (a JPMorgan Chase Company) (WePay Payments API)

Finastra (FusionFabric.cloud)

Plaid Inc. (Plaid Link)

Tink (Tink Platform)

N26 GmbH (N26 Banking App)

Kabbage, Inc. (a subsidiary of American Express) (Kabbage Funding)

Zelle (operated by Early Warning Services, LLC) (Zelle Payment Service)

By Type, Payment Segment Holds Dominant Market Share with 42.23% in 2023, Fund Transfer Segment Expected to Experience Rapid Growth

In 2023, the payment segment captured a significant market share of 42.23%, largely due to the increasing consumer preference for digital and cashless payments. This shift has prompted fintech companies to develop a variety of solutions, including mobile wallets, peer-to-peer transactions, and contactless payments. These innovations demonstrate the versatility of fintech, enabling individuals, businesses, and governments to benefit from the wide range of payment tools available in the market today.

The fund transfer segment is expected to witness the fastest growth in the forecast period, as demand for cross-border money transfers and withdrawals increases. Fintech companies across the world are developing apps that simplify fund transfers with features such as easy-to-use interfaces and improved customer experiences. While as more businesses and users use the platforms to make and receive funds across the globe, the funds transfer segment can become a chief driver of fintech market size growth.

Enquiry Before Buy: https://www.snsinsider.com/enquiry/3318

By Technology, Blockchain Segment Leads the Market with 38% Share in 2023, Artificial Intelligence Segment Set for Rapid Growth

The blockchain segment accounted for the highest market share in 2023, at approximately 38%, led by growing demand from large-scale enterprises. Blockchain provides advantages such as transparency and automation, appealing to financial institutions for improved security and efficiency. The technology guarantees users exclusive ownership and control over their assets, minimizing the threat of unauthorized use. These benefits are likely to continue fueling the growth of the blockchain segment in the next few years.

The artificial intelligence segment is expected to expand at the highest CAGR during the forecast period, driven by its extensive use in various industries. AI improves decision-making, solves queries quicker, and enhances efficiency in operations. It also leads to innovation, offering more customized, secure, and efficient services, enhancing customer satisfaction and global reach. As businesses continue to enhance their AI capabilities, the segment is set to experience considerable growth, supported by rising demand and competitive innovations.

By Application, Compliance and Regulatory Support Segment Leads the Market with 34% Share in 2023, Fueling Growth in Response to Rising Fraud and Customer Demands

The compliance and regulatory support segment was the market leader in 2023, capturing over 34.0% of global revenue. This dominance can be attributed to the growing importance of regulatory adherence among financial institutions, which are investing in customer support within their applications to streamline operations and enhance customer experience. Additionally, the rise in fraud and money laundering cases worldwide has prompted companies to strengthen their compliance measures and offer more robust customer support. As businesses continue to address these challenges, the segment is expected to see sustained growth throughout the forecast period, ensuring better service delivery globally.

By End-Use, Insurance Segment Dominates the Market with 36% Share in 2023, Driven by Technological Advancements in Fintech Solutions

The insurance segment led the market in 2023, accounting for approximately 36.0% of the total global revenue. This growth is largely driven by the increasing recognition of technology as a key factor in transforming and optimizing the insurance industry. Fintech solutions in this space provide a wide array of services, including digital underwriting, claim processing, policy management, and risk assessment. Leveraging modern data analytics, AI-driven algorithms, and automation, these solutions enhance the efficiency, quality, and user experience within insurance operations, positioning the segment for continued growth and innovation.

North America Dominates the Market with 42% Share in 2023, Asia-Pacific Holds 25% Market Share in 2023

In 2023, North America held the largest market share of 42%, cementing its position as a highly competitive region. Home to major tech giants, it boasts a high degree of digitalization, with widespread use of cloud computing, AI, and blockchain driving innovation and efficiency. The region benefits from significant R&D spending and a supportive legal framework, fueling the development of new technologies and services, ensuring its continued market leadership and economic growth.

Asia-Pacific is the second-largest market for Fintech-as-a-Service, with a 25% market share in 2023. Rapid economic growth and the increasing adoption of digital financial services in countries like China, India, and Japan are driving demand for FaaS. The region benefits from significant venture capital and government funding, fostering the growth of fintech companies. As more businesses recognize the advantages of FaaS platforms, the market is expected to expand, contributing to the region's growing fintech ecosystem.

Access Complete Report: https://www.snsinsider.com/reports/fintech-as-a-service-market-3318

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Jagney Dave

SNS Insider Pvt. Ltd

+1 315 636 4242

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release