Peer-to-Peer Lending Market to Reach USD 30.54 Billion by 2032| SNS Insider

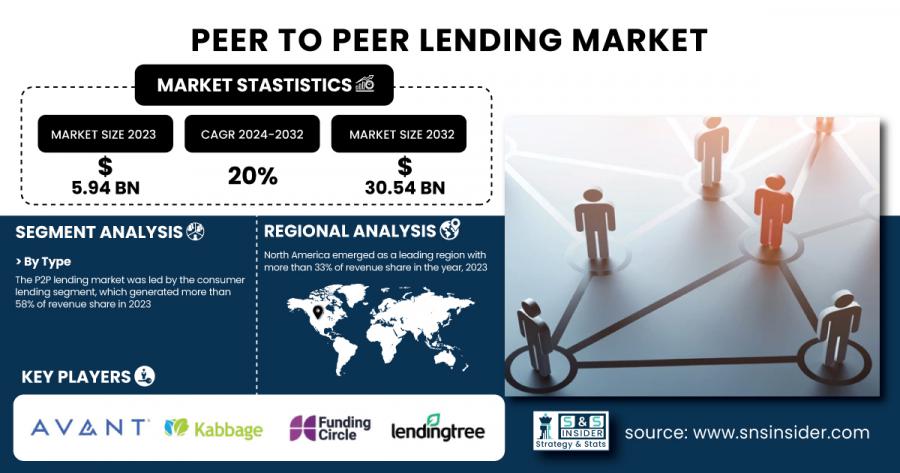

Peer-to-Peer Lending Market valued at $5.94 Bn in 2023, projected to reach $30.54 Bn by 2032, growing at a 20% CAGR over the 2024-2032 forecast period.

AUSTIN, TX, UNITED STATES, February 5, 2025 /EINPresswire.com/ -- Peer to Peer Lending Market was valued at USD 5.94 billion in 2023 and is expected to grow to USD 30.54 billion by 2032 and grow at a CAGR of 20% over the forecast period of 2024-2032.

Growth is driven by the increasing adoption of digital platforms, increasing demand for alternative lending options, and advancement in online lending technologies. Factors likely to drive this expansion include the development of regional network infrastructure, increased cybersecurity concerns, and increasing deployment of cloud services around the world.

Get Sample Copy of Report: https://www.snsinsider.com/sample-request/1278

Some of Major Keyplayers:

- Avant, LLC.

- Funding Circle

- Kabbage Inc.

- Lending Club Corporation

- LendingTree, LLC

- OnDeck

- Prosper Funding LLC

- RateSetter

- Social Finance, Inc

- Zopa Bank Limited

By Type, Consumer Lending Dominates, Business Lending Anticipated to Experience Significant Growth

Consumer lending was the leading P2P lending market in 2023, with over 58% of revenue. P2P provides low-interest services since there is almost negligible overhead expense. Business lending is expected to grow rapidly, more than ever, as it will be easier and faster for small businesses, including startups.

By End-user, Non-Business Loans Dominate, Business Loans Poised for Strong Growth

In 2023, non-business loans dominated the market for P2P lending with a 73% share of revenue. Personal loans will cover a host of needs. P2P platforms offer greater flexibility in sizes and repayment terms, making the option suitable for smaller loans. Business loans would grow at the fastest 22.1% CAGR from 2024 to 2032. P2P lending provides a source of alternate funding for SMEs, when traditional loans would not be so easily available for early or unsure financial stages.

By Loan Type, Secured Loans Dominating the Peer-to-Peer Lending Market

Secured loans have dominated the Peer-to-Peer lending market mainly because they pose lesser risks to lenders. For offering collateral, the borrowers reduce the exposure of the lender to default, thus securing a lower interest rate. Therefore, secured loans attract not only the borrowers looking for good rates but also other lenders targeting safer investments

By Purpose Type, Repaying Bank Debt Dominating the Peer-to-Peer Lending Market

Repaying bank debt has become the dominant purpose in the Peer-to-Peer (P2P) lending market as borrowers seek to consolidate or refinance their existing obligations. Many individuals face high interest rates and burdensome debt from traditional banks, so they turn to P2P platforms for better terms and lower costs. Through P2P lending, borrowers can access competitive rates and reduce overall debt, fostering improved financial health.

Peer to peer lending Market Segmentation:

By Type

- Consumer Lending

- Business Lending

By Loan Type

- Secured

- Unsecured

By Purpose Type

- Repaying Bank Debt

- Family Celebration

- Credit Card Recycling

- Buying Car

- Education

- Home Renovation

- Others

By End-user

- Non Business Loans

- Business Loans

Enquiry Before Buy this Report: https://www.snsinsider.com/enquiry/1278

North America Leads in P2P Lending, While Asia Pacific Experiences Rapid Growth

North America accounted for over 33% of the P2P lending market share in 2023, driven by an established, technology-focused financial ecosystem. The region’s widespread use of digital platforms makes online loans and investments popular among borrowers and investors. Additionally, a developing regulatory framework supports P2P growth.

Asia Pacific is expected to grow at the highest CAGR of 22% during the forecast period. The region, with a significant unbanked population, is embracing P2P lending as an alternative funding source. Rapid economic growth, entrepreneurship, and small business expansion further drive the demand for P2P lending services.

Access Complete Report: https://www.snsinsider.com/reports/peer-to-peer-lending-market-1278

Table of Content:

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Peer to peer lending Market Segmentation, by Type

8. Peer to peer lending Market Segmentation, by Loan Type

9. Peer to peer lending Market Segmentation, by Purpose Type

10. Peer to peer lending Market Segmentation, by end user

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release