Cyber Insurance Market to Reach USD 97.3 Billion by 2032| SNS Insider

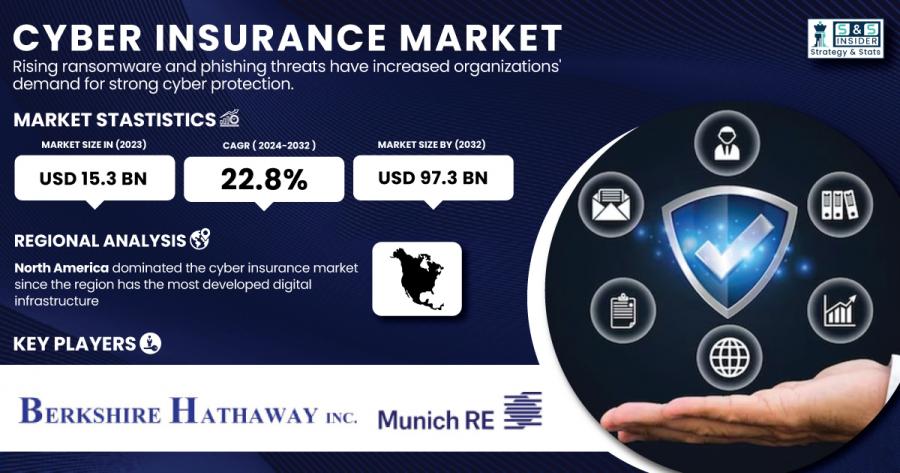

SNS Insider reports Cyber Insurance Market at $15.3 Bn in 2023, projected to reach $97.3 Bn by 2032, growing at a 22.8% CAGR during the forecast period.

AUSTIN, TX, UNITED STATES, February 5, 2025 /EINPresswire.com/ -- The SNS Insider report indicates that the Cyber Insurance Market was valued at USD 15.3 billion in 2023 and is expected to reach USD 97.3 billion by 2032, growing at a CAGR of 22.8% during the forecast period.

The surge in cyberattacks, stringent regulatory frameworks, and growing awareness of financial risks associated with data breaches are key drivers of market growth. Organizations across industries are increasing their cybersecurity investments, further fueling the adoption of cyber insurance policies.

Get Sample Copy of Report: https://www.snsinsider.com/sample-request/1268

Some of Major Keyplayers:

- Allianz (Allianz Cyber Protect)

- American International Group, Inc. (AIG) (CyberEdge)

- Aon plc (Cyber Solutions)

- AXA (AXA Cyber Secure)

- Berkshire Hathaway Inc. (Cyber Liability Insurance)

- Lloyd’s of London Ltd. (Cyber Cover)

- Lockton Companies, Inc. (Lockton Cyber Risk Solutions)

- Munich Re (Cyber Re)

- The Chubb Corporation (Cyber Enterprise Risk Management)

- Zurich (Security and Privacy Protection)

- Beazley plc (Beazley Breach Response)

- CNA Financial Corporation (CNA CyberPrep)

- Travelers Companies, Inc. (CyberRisk)

- Hiscox Ltd. (Hiscox CyberClear)

- Liberty Mutual Insurance (Liberty Cyber Suite)

- Sompo International (Cyber Solutions Plus)

- Tokio Marine HCC (NetGuard Plus)

- Hartford Steam Boiler (HSB) (HSB Total Cyber™)

- QBE Insurance Group (Cyber Event Protection)

- Argo Group (Argo Cyber Suite)

By Insurance Type, Standalone Policies Dominate While Tailored Policies Experience Rapid Growth

Standalone accounts for the largest segment owing to its extensive reach and widespread use by large enterprises. Standalone cyber insurance policy are still favored by organizations as they offer wider coverage against data breaches and financial losses and cyber extortion incidents.

By Coverage Type, First-Party Coverage Leads, While Liability Coverage Grows Rapidly

The First Party segment dominates the market, as it encompasses direct financial losses due to cyber events like data recovery costs, business interruption, and extortion payments. First-party coverage the bread and butter for companies looking to protect their financial assets from ransomware attacks and operational disruptions.

By Enterprise Type, Large Enterprises Dominate, While SMEs Register the Fastest Growth

The Large Enterprises segment dominated the market and accounted for 62% of revenue, due to the availability of higher cybersecurity budgets and larger enterprises have more comprehensive and complex risks that require covering. BFSI, healthcare, and IT & telecom are some of the major verticals where large organizations are investing heavily to purchase cyber insurance against advanced cyber threats.

By End-User, BFSI Leads the Market While Healthcare Experiences the Fastest Growth

The Large Enterprises segment is expected to be the larger segment during the forecast period due to the availability of higher cybersecurity budgets and larger enterprises have more comprehensive and complex risks that require covering. BFSI, healthcare, and IT & telecom are some of the major verticals where large organizations are investing heavily to purchase cyber insurance against advanced cyber threats.

The SMEs are projected to grow at the fastest CAGR during the forecast period, due to the continuously increasing number of cyberattacks on small businesses. This segment is benefitting from the increasing awareness about cyber insurance in SMEs and availability of affordable and flexible plans.

Cyber Insurance Market Segmentation:

By Insurance Type

- Standalone

- Tailored

By Coverage Type

- First-Party

- Liability Coverage

By Enterprise Size

- SMEs

- Large Enterprise

By End-User

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Manufacturing

- Others

Enquiry Before Buy this Report: https://www.snsinsider.com/enquiry/1268

North America Leads the Cyber Insurance Market, Asia-Pacific Registers the Fastest CAGR

North America dominated the market and accounted for a significant revenue share, which is attributed to the increasing regulations regarding cybersecurity and the high prevalence of cyberattacks and use of the insurance. Some of the significant cyber insurance providers are based in the U.S. and Canada, where most of the investment from BFSI, IT & Healthcare is focused on cyber risk management solutions.

Access Complete Report: https://www.snsinsider.com/reports/cyber-insurance-market-1268

Table of Content:

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Cyber Insurance Market Segmentation, By Insurance Type

8. Cyber Insurance Market Segmentation, By Coverage Type

9. Cyber Insurance Market Segmentation, By Enterprise Size

10. Cyber Insurance Market Segmentation, By End-User

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release