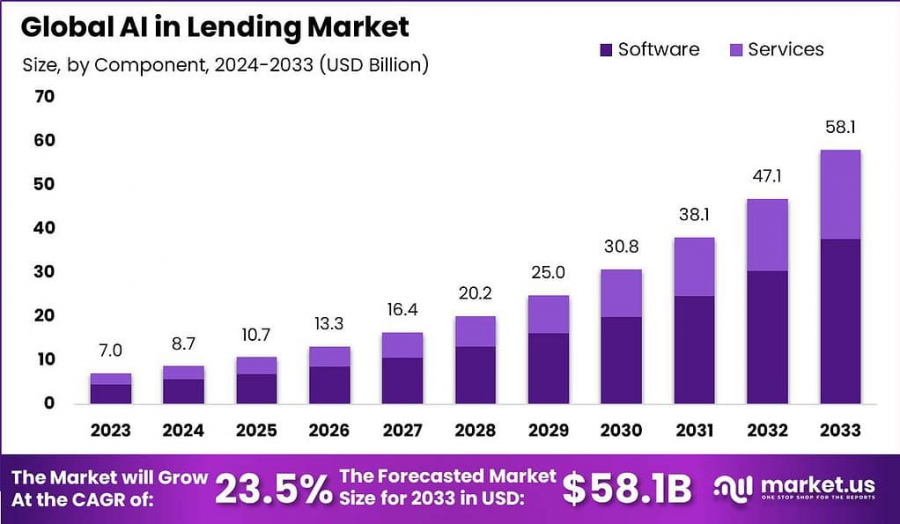

AI in Lending Market Boosts Personalized Customer Services By USD 58.1 billion by 2033, CAGR of 23.5%

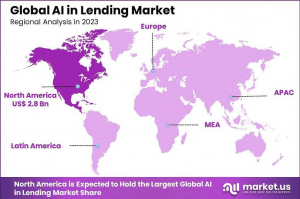

In 2023, North America held a dominant market position in the AI Lending market, capturing more than a 40% share...

NEW YORK, NY, UNITED STATES, February 3, 2025 /EINPresswire.com/ -- The AI in Lending Market is poised for substantial growth, projected to reach USD 58.1 billion by 2033, up from USD 7.0 billion in 2023, with a remarkable CAGR of 23.5% during the forecast period. This surge stems from the widespread adoption of AI technologies in financial services, revolutionizing how lending decisions are made by using advanced data analytics and machine learning algorithms.

These technologies allow lenders to process vast amounts of structured and unstructured data, including financial records and social media activity, to accurately assess creditworthiness and tailor loan offerings. The automation of lending processes, such as data entry and verification through AI, significantly enhances operational efficiency, reduces errors, and speeds up loan approval times, providing a seamless customer experience.

🔴 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 @ https://market.us/report/ai-in-lending-market/request-sample/

Despite challenges like data privacy and security concerns, the benefits of AI in lending, such as cost reduction and increased access to credit, are evident. As regulatory bodies acknowledge the advantages of AI, the market is set for further expansion, with financial institutions leveraging AI to enhance compliance, risk management, and customer engagement.

The growing availability of cloud-based AI solutions also supports this trend, enabling institutions of all sizes to deploy sophisticated tools without heavy on-premises infrastructure investments.

Key Takeaways

The Global AI in Lending Market size is estimated to reach USD 58.1 billion in the year 2033 with a CAGR of 23.5% during the forecast period and was valued at USD 7.0 billion in the year 2023.

In 2023, the software segment held a leading market position in the AI Lending market, capturing more than a 65% share.

In 2023, the cloud-based segment held a dominant market position in the AI Lending market, capturing more than a 70% share.

In 2023, the Machine Learning (ML) and Predictive Analytics segment held a dominant market position in the AI Lending market, capturing more than a 51% share.

In 2023, the Banks and Financial Institutions (BFSI) segment held a dominant market position in the AI Lending market, capturing more than a 45% share.

In 2023, North America held a dominant market position in the AI Lending market, capturing more than a 40% share.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=122210

Experts Review

Experts highlight the transformative role of AI in the lending sector, emphasizing its capacity to revolutionize credit risk assessment and operational efficiency. By employing machine learning algorithms, lenders can analyze vast data sets with unprecedented speed and accuracy, leading to more informed and fair lending decisions.

Despite clear advantages, experts acknowledge challenges such as data privacy concerns and the need for transparency in AI algorithms. The interpretability of AI models remains crucial to prevent bias and ensure ethical lending practices. Nonetheless, the ability of AI to automate processes and provide personalized borrower insights makes it indispensable for modern financial services.

Experts foresee continuous growth in AI adoption as regulatory environments mature and technological capabilities expand, enabling lenders to enhance customer experiences and improve profitability. Furthermore, ongoing advancements in AI models and increasing regulatory support are likely to encourage broader implementation, making AI a cornerstone technology in the evolution of the lending industry.

🔴 𝐇𝐮𝐫𝐫𝐲 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 𝐅𝐨𝐫 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲 @ https://market.us/purchase-report/?report_id=122210

Report Segmentation

The AI in Lending Market is segmented by components, deployment mode, technology, and end-users. Components are categorized into software and services, with software leading due to its crucial role in deploying AI tools for data analysis and decision-making processes. Continuous advancements in AI software enhance capabilities for lenders, optimizing loan origination and management systems.

Deployment modes include cloud-based and on-premises solutions, where cloud-based solutions dominate due to their scalability, cost-effectiveness, and capacity to support remote operations. Cloud platforms facilitate real-time data access and collaboration, essential for modern lending environments, especially in the era of remote work.

By technology, the market is segmented into machine learning and predictive analytics, natural language processing (NLP), robotic process automation (RPA), and other AI technologies. Machine learning and predictive analytics capture the largest share, fundamentally reshaping credit risk assessments and fraud detection processes.

End-users are categorized into banks and financial institutions, credit unions, peer-to-peer (P2P) lending platforms, and other lenders. Banks and financial institutions hold the largest market share, leveraging AI to streamline operations and enhance customer satisfaction. This segmentation highlights the diverse applications and the growing importance of AI technologies in reshaping traditional lending processes across various financial sectors.

🔴 𝐆𝐞𝐭 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭 (𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐏𝐞𝐫𝐢𝐨𝐝 𝐎𝐧𝐥𝐲) @ https://market.us/purchase-report/?report_id=122210

Key Market Segments

By Component

Software

Services

By Deployment Mode

Cloud-based

On-premises

By Technology

Machine Learning and Predictive Analytics

Natural Language Processing (NLP)

Robotic Process Automation (RPA)

Other AI Technologies

By End-User

Banks and Financial Institutions

Credit Unions

Peer-to-peer (P2P) Lending Platforms

Other Lenders

Drivers, Restraints, Challenges, and Opportunities

The AI in Lending Market is driven by the increasing need for efficiency and speed in lending operations and the ability of AI to process vast data for informed decision-making. AI technologies improve the accuracy of credit risk assessments and enable personalized loan offerings, enhancing customer satisfaction and loyalty.

However, significant restraints include data privacy and security concerns, as handling sensitive customer information entails robust protection measures. The lack of a skilled workforce to manage and interpret AI technologies is another challenge, posing a barrier to widespread adoption.

Opportunities arise from the growing trend of machine learning and predictive analytics, offering transformative potential to enhance credit risk models and enable dynamic pricing. These technologies grant lenders the ability to adapt to varying market conditions and borrower behaviors in real time.

The rise of cloud-based AI solutions presents additional opportunities by reducing infrastructure costs and allowing smaller financial institutions to compete on a level playing field with larger banks. As AI technologies continue to evolve, their ability to automate and enhance specificity in lending processes is expected to increase, driving further market growth. Firms investing in AI innovations and addressing compliance and ethical considerations will be well-positioned to capitalize on these lucrative opportunities in the evolving financial landscape.

Key Player Analysis

Leading players in the AI in Lending Market include notable companies like Upstart Holdings, LendingClub Corporation, and Kabbage, which significantly influence market dynamics through innovation. Upstart Holdings leverages sophisticated machine learning algorithms to improve risk prediction and loan approval processes, achieving higher approval rates and fewer losses.

LendingClub focuses on offering personalized lending experiences through AI-driven insights into credit decisions. Kabbage, a subsidiary of American Express, utilizes automated solutions to streamline funding for small businesses, thus speeding up financial assessments and accessibility.

Zest AI and OnDeck Capital also play pivotal roles, with Zest AI enhancing credit scoring accuracy through innovative AI models and OnDeck using AI to ensure quick and reliable loan processing for small enterprises. These companies exemplify the transformative impact of AI in lending, continuously investing in cutting-edge technologies to improve lending efficiency, customer experience, and inclusivity across financial services. Their strategic focus on AI innovation positions them as leaders in this rapidly evolving industry.

Top Key Players in the Market

Upstart Holdings, Inc.

LendingClub Corporation

Kabbage (a subsidiary of American Express)

Zest AI

OnDeck Capital Inc.

Avant LLC

SoFi Technologies Inc.

Enova International Inc.

OakNorth Bank

Prosper Marketplace Inc.

PayPal Holdings Inc.

Better Mortgage Corporation

Figure Technologies Inc.

Funding Circle Holdings PLC

LenddoEFL

Other Key Players

Recent Developments

Significant recent advancements have been made in the AI in Lending Market, focusing on technological innovation and strategic growth. In May 2024, Upstart Holdings launched the first AI certification program aimed at empowering financial services leaders to harness AI in lending practices more effectively, marking a significant step in industry education and adoption.

In February 2024, Zest AI introduced LuLu, a generative AI model designed to optimize performance in lending organizations by enhancing data insight accessibility and decision-making processes. These developments illustrate ongoing efforts to deepen AI integration into financial services, highlighting the potential of AI-driven innovations to streamline lending operations and improve decision-making accuracy.

As AI technologies advance, lending institutions increasingly recognize their value in enhancing customer engagement and operational efficiency. These recent developments reflect the market's commitment to leveraging AI's transformative capabilities, ensuring robust growth and ongoing adaptation to technological and market changes in the lending sector.

Conclusion

The AI in Lending Market is on a strong growth trajectory, with AI technologies fundamentally transforming how credit risk is assessed and lending processes are conducted. Despite challenges like data privacy concerns and high implementation costs, the opportunities presented by AI-driven innovation in enhancing efficiency, personalization, and decision-making are substantial.

Key industry players are pioneering advancements, driving market dynamics by embracing machine learning and predictive analytics. As AI technologies continue to evolve and regulatory frameworks mature, they offer immense potential to improve customer experiences and operational profitability in the lending industry, marking a revolutionary shift in financial services.

➤ 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐎𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭𝐞𝐝 𝐓𝐨𝐩𝐢𝐜𝐬

Family Tracking App Market - https://market.us/report/family-tracking-app-market/

A2P Messaging Market - https://market.us/report/a2p-messaging-market/

FinTech Blockchain Market - https://market.us/report/fintech-blockchain-market/

Blockchain Technology In BFSI Market - https://market.us/report/blockchain-technology-in-bfsi-market/

Dental Practice Management Software Market - https://market.us/report/dental-practice-management-software-market/

Data Center Liquid Cooling Market - https://market.us/report/data-center-liquid-cooling-market/

Defense Cybersecurity Market - https://market.us/report/defense-cybersecurity-market/

Digital Transformation Market - https://market.us/report/digital-transformation-market/

ERP Software Market - https://market.us/report/erp-software-market/

Online Charging System (OCS) Market - https://market.us/report/online-charging-system-ocs-market/

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release