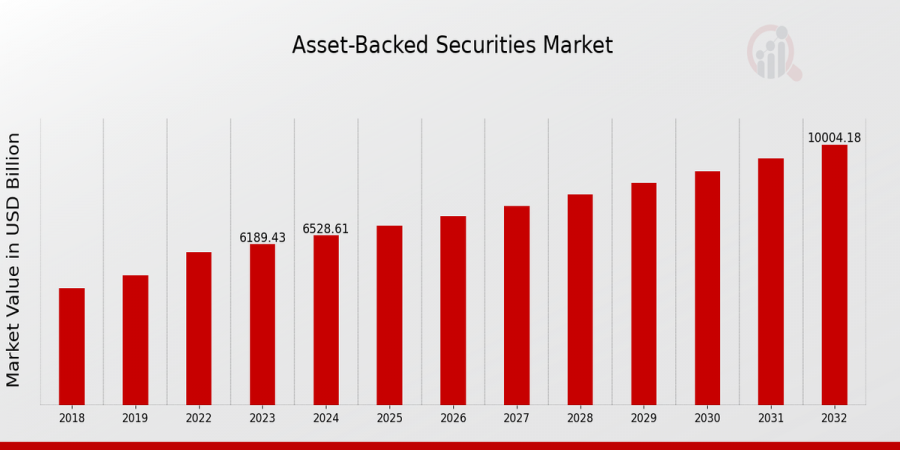

Asset-backed Securities Market Size is Projected to Attain $10,000.0 Billion By 2032

Asset-backed Securities Market Research Report By, Asset Class, Security Structure, Credit Rating, Maturity, Regional

VA, UNITED STATES, January 23, 2025 /EINPresswire.com/ -- The global Asset-Backed Securities (ABS) Market is witnessing steady growth and is poised to expand significantly over the next decade. In 2022, the market size was valued at USD 5,867.87 billion and is projected to grow from USD 6,189.43 billion in 2023 to USD 10,000 billion by 2032, reflecting a compound annual growth rate (CAGR) of 5.48% during the forecast period (2024–2032). This growth is driven by increasing demand for structured financial products, evolving regulatory frameworks, and a growing emphasis on capital market innovation.

Key Drivers Of Market Growth

➤ Rising Demand for Structured Financial Products

Investors are increasingly seeking diversified portfolios with reduced risk. Asset-backed securities, offering a blend of liquidity and stability, cater to this demand.

➤ Growth in Consumer Credit

The expansion of consumer credit markets, including auto loans, credit card receivables, and student loans, is driving the origination of new asset-backed securities.

➤ Evolving Regulatory Frameworks

Governments and financial authorities are implementing policies to enhance transparency and investor confidence in securitized assets, fostering market growth.

➤ Technological Advancements in Financial Markets

The integration of blockchain and advanced analytics in the securitization process has improved efficiency and reduced operational costs, further propelling the market.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/23890

Key Companies In The Asset- Backed Securities Market

• Credit Suisse

• Citigroup

• Wells Fargo

• Royal Bank of Canada

• Barclays

• Deutsche Bank

• JPMorgan Chase

• Morgan Stanley

• BNP Paribas

• Société Générale

• UBS

• Goldman Sachs

• Bank of America Merrill Lynch

• ING

• HSBC

Browse In-depth Market Research Report : https://www.marketresearchfuture.com/reports/asset-backed-securities-market-23890

Market Segmentation -

1. By Asset Type

• Residential Mortgage-Backed Securities (RMBS): Backed by residential real estate mortgages.

• Commercial Mortgage-Backed Securities (CMBS): Derived from commercial real estate loans.

• Consumer Loans: Includes auto loans, credit card receivables, and student loans.

• Others: Securitized pools of diverse assets like equipment leases and small business loans.

2. By End User

• Institutional Investors: Pension funds, insurance companies, and hedge funds.

• Retail Investors: Individuals investing via mutual funds and exchange-traded funds (ETFs).

3. By Region

• North America: Largest market, driven by strong capital markets and regulatory developments.

• Europe: Steady growth attributed to increasing adoption of securitization in financial institutions.

• Asia-Pacific: Rapidly growing region due to the rising demand for asset-backed securities in emerging markets like China and India.

• Rest of the World (RoW): Moderate growth expected in the Middle East, Africa, and Latin America.

Procure Complete Research Report Now : https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=23890

The Asset-Backed Securities Market is on a trajectory of steady growth, supported by advancements in financial technologies and increasing reliance on structured products for risk management. As the financial ecosystem evolves, ABS will play a vital role in meeting the capital market's dynamic needs and addressing investor appetite for diverse and secure investment options.

Related Report:

Open Banking Systems Market

https://www.marketresearchfuture.com/reports/open-banking-systems-market-23891

Charge Card Market

https://www.marketresearchfuture.com/reports/charge-card-market-23906

Credit Card Issuance Services Market

https://www.marketresearchfuture.com/reports/credit-card-issuance-services-market-23888

Credit Card Payment Market

https://www.marketresearchfuture.com/reports/credit-card-payment-market-23915

Emv Smart Cards Market

https://www.marketresearchfuture.com/reports/emv-smart-cards-market-23876

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release