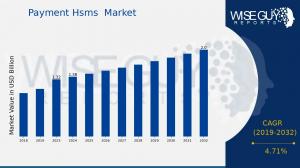

Payment Hsms Market Size to Hit US$ 2.0 Billion by 2032, At a CAGR of 4.71%

Global Payment Hsms Market Report By Authentication Technologies, Payment Hsms Types, Data Security, Applications, Deployment Models, Regional- Forecast to 2032

CA, UNITED STATES, January 13, 2025 /EINPresswire.com/ -- The Payment HSMs (Hardware Security Modules) market, valued at USD 1.32 billion in 2023, is on a steady growth trajectory, with expectations to reach USD 1.38 billion in 2024. The market is projected to expand further, reaching USD 2.0 billion by 2032. This represents a Compound Annual Growth Rate (CAGR) of 4.71% during the forecast period from 2024 to 2032.The Payment HSM market is driven by increasing concerns over data security, the proliferation of digital transactions, and the growing adoption of contactless payment technologies. As financial services and online transactions continue to evolve, there is an increasing need for secure cryptographic systems that protect sensitive payment information. HSMs are used across a wide range of industries, from banking to retail, for secure key management, encryption, and authentication.

𝐊𝐞𝐲 𝐂𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐇𝐬𝐦𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐜𝐥𝐮𝐝𝐞:

• IBM Corporation

• Misys

• Temenos AG

• FIS

• Finastra

• SAP SE

• Capgemini

• PwC

• Accenture

• NTT DATA Corporation

• Infosys

• Oracle Corporation

• Wipro Limited

• ACI Worldwide

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬

https://www.wiseguyreports.com/sample-request?id=590766

𝐊𝐞𝐲 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐌𝐚𝐫𝐤𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

Rising Demand for Secure Payment Solutions

The shift towards cashless transactions, both online and offline, has significantly contributed to the growing demand for robust security solutions. Payment HSMs provide critical support for secure payment authentication and encryption, ensuring that sensitive customer data, including credit card information, remains protected against cyber threats.

Regulatory Requirements and Compliance

Increasing regulations around data protection, such as the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS), have made it imperative for organizations to invest in advanced security technologies like Payment HSMs. Compliance with these regulations is a major driver for businesses, especially financial institutions, to adopt HSM solutions.

Growing Adoption of Contactless Payments and Digital Wallets

The rapid growth in mobile wallets, digital currencies, and contactless payment systems has led to a greater reliance on secure cryptographic mechanisms. Payment HSMs are essential for securing these systems, offering a secure environment for storing private keys and processing secure transactions.

Rising Cybersecurity Threats

As cyber-attacks become more sophisticated, there is an urgent need to enhance the protection of payment infrastructure. Payment HSMs mitigate the risk of data breaches, fraud, and financial theft by ensuring the integrity and confidentiality of sensitive information.

𝐁𝐫𝐨𝐰𝐬𝐞 𝐈𝐧-𝐝𝐞𝐩𝐭𝐡 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 (𝟏𝟏𝟎 𝐏𝐚𝐠𝐞𝐬) 𝐨𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐇𝐬𝐦𝐬 𝐌𝐚𝐫𝐤𝐞𝐭:

https://www.wiseguyreports.com/reports/payment-hsms-market

𝐌𝐚𝐫𝐤𝐞𝐭 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐚𝐭𝐢𝐨𝐧

The Payment HSMs market can be segmented based on Type, Deployment Mode, End-User, and Region:

By Type

Cloud-Based HSMs

Cloud-based HSM solutions are gaining popularity due to their cost-efficiency, scalability, and ease of deployment. These HSMs are hosted in a cloud environment, offering businesses a flexible and secure solution without the need for extensive hardware infrastructure. The market for cloud-based HSMs is expected to grow significantly as more organizations embrace cloud computing.

On-Premise HSMs

On-premise HSMs continue to be preferred by financial institutions and enterprises that require full control over their payment systems and data. These solutions are often deployed in highly secure data centers and offer robust performance for handling high volumes of transactions. While on-premise solutions are expected to hold a larger share in the market, cloud-based solutions are catching up quickly due to their flexibility.

By Deployment Mode

On-Premise Deployment

On-premise HSMs are favored by large financial institutions and organizations with stringent security requirements. This mode of deployment allows businesses to maintain physical control over their infrastructure and security protocols, which is critical for managing sensitive financial data.

Cloud Deployment

With the rapid adoption of cloud technologies, many businesses are shifting to cloud-based deployment models. Cloud Payment HSMs offer scalability, cost-effectiveness, and ease of maintenance, making them an attractive choice for small to medium-sized enterprises (SMEs) and organizations operating in fast-changing environments.

By End-User

Banking and Financial Services

The largest share of the Payment HSM market is held by the banking and financial services sector. HSMs are extensively used for securing payment transactions, protecting cardholder data, and ensuring compliance with regulations like PCI DSS. As digital payments grow, banks are increasingly relying on Payment HSMs to protect sensitive data.

Retail and E-commerce

Retailers and e-commerce businesses are adopting HSMs to secure online payment systems and ensure the safety of consumer transactions. The rise in online shopping, coupled with the need for secure payment processing, is propelling the demand for Payment HSMs in this segment.

Government and Public Sector

Governments are adopting HSMs to protect sensitive national data, including citizen payment records and tax data. HSMs play a key role in ensuring data integrity, especially in the context of digital payment solutions implemented for tax collection and public services.

Others

Other sectors, such as telecommunications and healthcare, are also adopting Payment HSMs for securing payment data and ensuring compliance with industry-specific regulations.

By Region

North America- North America remains a dominant market for Payment HSMs, driven by the presence of large financial institutions and technology companies. The U.S. leads the market due to the high adoption of digital payment systems and stringent cybersecurity regulations.

Europe- Europe is another key market, with increasing adoption of secure payment systems across the banking and retail sectors. The EU's regulatory framework, particularly GDPR, has heightened the need for secure HSM solutions.

Asia Pacific- The APAC region is expected to experience the highest growth rate during the forecast period. Countries like China, India, and Japan are rapidly embracing digital payments, and the growing demand for secure transaction solutions is driving the adoption of Payment HSMs.

Latin America and Middle East & Africa- Both regions are witnessing steady growth in the Payment HSM market, primarily due to an increase in digital payment adoption and rising awareness of cybersecurity risks.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰:

https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=590766

𝐅𝐮𝐭𝐮𝐫𝐞 𝐎𝐮𝐭𝐥𝐨𝐨𝐤

The Payment HSM market is expected to maintain a strong growth trajectory over the next decade. With the continued rise of digital payments, regulatory pressures, and evolving cybersecurity threats, the demand for advanced, scalable, and secure payment solutions will keep driving the adoption of Payment HSMs. Cloud-based solutions, in particular, are anticipated to become more widespread as businesses seek flexible and cost-effective options.

As the market evolves, innovation in security technologies and payment systems will further propel the growth of Payment HSMs. Companies that can effectively balance security, performance, and scalability will be well-positioned to capitalize on the increasing need for secure and reliable payment systems across various industries.

𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭:

Seven Segment Displays Market

https://www.wiseguyreports.com/reports/seven-segment-displays-market

Rgb Fan Market

https://www.wiseguyreports.com/reports/rgb-fan-market

Led Holder Market

https://www.wiseguyreports.com/reports/led-holder-market

Rotary Motion Sensor Market

https://www.wiseguyreports.com/reports/rotary-motion-sensor-market

Quantum Computer Chip Market

https://www.wiseguyreports.com/reports/quantum-computer-chip-market

Tlc Flash Market

https://www.wiseguyreports.com/reports/tlc-flash-market

Fax Adapter Market

https://www.wiseguyreports.com/reports/fax-adapter-market

Iris Recognition Technology Market

https://www.wiseguyreports.com/reports/iris-recognition-technology-market

𝐀𝐛𝐨𝐮𝐭 𝐖𝐢𝐬𝐞 𝐆𝐮𝐲 𝐑𝐞𝐩𝐨𝐫𝐭𝐬

𝖠𝗍 𝖶𝗂𝗌𝖾 𝖦𝗎𝗒 𝖱𝖾𝗉𝗈𝗋𝗍𝗌, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new Market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

WiseGuyReports (WGR)

WISEGUY RESEARCH CONSULTANTS PVT LTD

+1 628-258-0070

email us here

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release